Chase CD rates are an essential consideration for anyone looking to grow their savings safely and effectively. With various options available, understanding the nuances of these rates can help you make informed financial decisions. In this article, we will explore Chase's Certificate of Deposit (CD) offerings, their benefits, and how you can leverage them to achieve your financial goals.

Chase, one of the largest banks in the United States, provides a range of financial products, including competitive CD rates. By choosing a CD, you can lock in your interest rate for a fixed period, which can be a smart choice in a fluctuating interest rate environment. However, it’s crucial to compare these rates with other financial institutions to ensure you’re getting the best return on your investment.

In the following sections, we will delve deeper into the specifics of Chase CD rates, how they compare to other banking options, and what you need to consider before opening an account. Whether you are a first-time saver or looking to diversify your investment portfolio, this guide will provide valuable insights to help you navigate your options.

Table of Contents

- What Are CDs?

- Chase CD Rates Overview

- Benefits of Chase CDs

- How to Open a Chase CD

- Chase CD Terms and Conditions

- Comparing Chase CD Rates with Competitors

- Common Questions About Chase CDs

- Conclusion

What Are CDs?

A Certificate of Deposit (CD) is a financial product offered by banks and credit unions that allows you to deposit a lump sum of money for a fixed period in exchange for a higher interest rate than a traditional savings account. Here are some key characteristics of CDs:

- Fixed interest rates: CDs typically offer fixed interest rates, meaning your return is guaranteed for the duration of the term.

- Varied terms: CD terms can range from a few months to several years, giving you flexibility based on your financial goals.

- Early withdrawal penalties: Withdrawing funds before the maturity date often incurs penalties, so it’s important to choose a term that aligns with your liquidity needs.

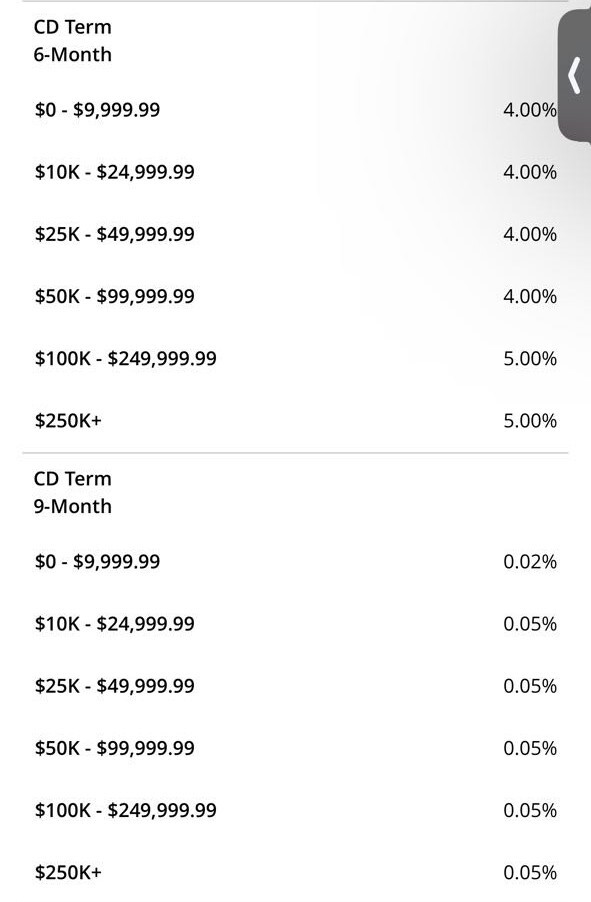

Chase CD Rates Overview

As of [insert date], Chase offers a variety of CD options with competitive rates. Here is a breakdown of their standard offerings:

| CD Term | APY (Annual Percentage Yield) |

|---|---|

| 1 Month | 0.01% |

| 3 Months | 0.05% |

| 6 Months | 0.05% |

| 9 Months | 0.05% |

| 12 Months | 0.15% |

| 24 Months | 0.25% |

Benefits of Chase CDs

Choosing a CD from Chase comes with several advantages:

- Security: CDs are FDIC insured up to the applicable limits, providing peace of mind for your investments.

- Predictable returns: With fixed interest rates, you can plan your finances without worrying about market fluctuations.

- Easy access to funds after maturity: Chase offers options to reinvest or withdraw funds upon maturity, making it convenient for savers.

How to Open a Chase CD

Opening a Chase CD is a straightforward process. Follow these steps:

- Visit the Chase website or your local branch.

- Choose the CD term that suits your financial goals.

- Complete the application form, providing necessary identification and funding information.

- Deposit the minimum required amount, which typically ranges from $1,000 to $10,000, depending on the CD type.

- Review and confirm your application.

Chase CD Terms and Conditions

Before opening a CD, it's essential to understand the terms and conditions associated with it. Here are some critical points to consider:

- Minimum deposit requirements vary by CD term.

- Interest rates may change periodically, but the rate you lock in at account opening will remain for the term.

- Early withdrawal penalties can reduce your interest earnings, so plan your withdrawal carefully.

Comparing Chase CD Rates with Competitors

When considering where to open a CD, it's prudent to compare rates with other banks. Some of the leading competitors include:

- Ally Bank: Known for high rates and no minimum deposit.

- Capital One: Offers competitive rates with flexible terms.

- Synchrony Bank: Features some of the highest CD rates in the market.

By comparing rates and terms, you can ensure you’re making the best financial decision for your savings.

Common Questions About Chase CDs

Here are some frequently asked questions regarding Chase CDs:

- Can I withdraw money from my CD before maturity? Yes, but early withdrawal may incur penalties.

- What happens at the end of my CD term? You can choose to withdraw your funds, roll them into a new CD, or transfer to another account.

- Are Chase CDs insured? Yes, CDs are FDIC insured up to $250,000 per depositor, per bank.

Conclusion

In summary, Chase CD rates offer a reliable way to grow your savings with minimal risk. By understanding the features and benefits of these financial products, you can make an informed decision that aligns with your financial goals. Don’t forget to compare rates and consider your liquidity needs before committing to a CD. If you have any questions or would like to share your experiences with Chase CDs, feel free to leave a comment below!

Call to Action

If you found this article helpful, please consider sharing it with friends or family who may also benefit from learning about Chase CD rates. Check out our other articles for more financial tips and insights!

Thank you for reading, and we look forward to seeing you back on our site for more informative content!

Creative And Heartfelt Wording Ideas For Christening Cards

Chavit Singson Net Worth: A Comprehensive Insight Into His Wealth

Karen Taylor: The Life And Legacy Of Travis Taylor's Wife